Introduction

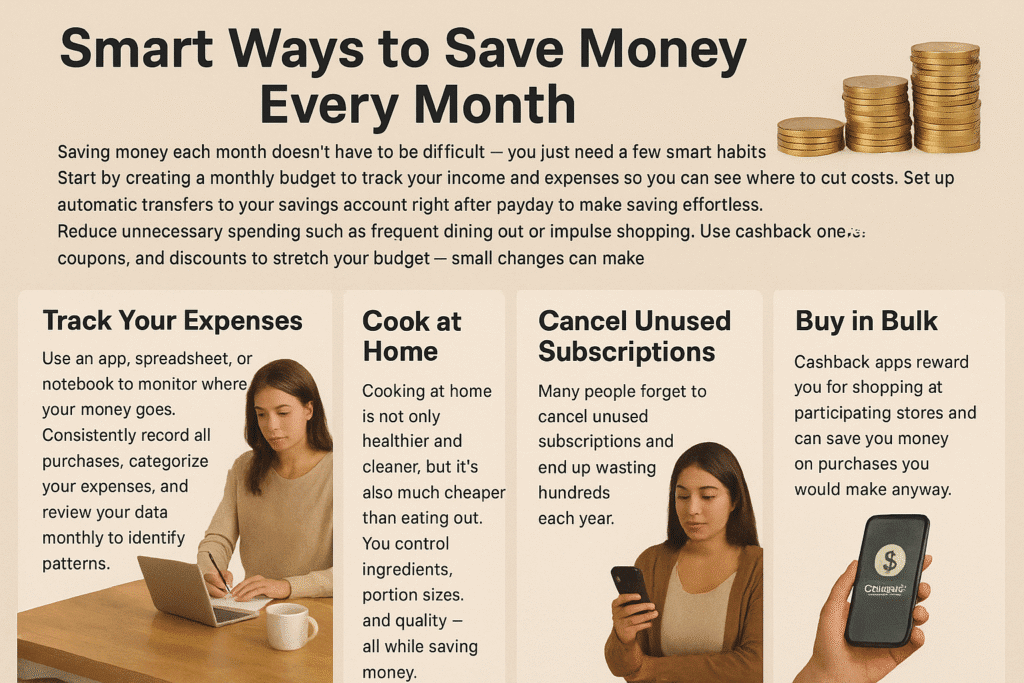

If you use some clever techniques, saving money each month doesn’t have to be hard.

Making a monthly budget that keeps track of your earnings and outlays and helps you find areas where you can cut costs is one smart tactic.

To help you save before you spend, you should also set up automatic transfers to your savings account as soon as you receive your paycheck.

Cutting back on wasteful spending, like eating out frequently or shopping on the spur of the moment, can also have a significant impact. Another way to save money when you shop is to use cashback offers, coupons, and discounts.

Lastly, you can save even more money by going over your subscriptions and cancelling those you don’t use frequently.

Track Expenses

Use an app, spreadsheet, or notebook to keep track of your spending, depending on your spending patterns and financial constraints.

To improve your financial habits, it’s important to consistently record all of your purchases, classify your spending, and periodically review your data.

Techniques for monitoring spending Apps for tracking expenses How it operates: Numerous apps automatically track and classify your spending by connecting to your bank and credit card accounts.

Cash purchases can also be manually added.

Advantages: incredibly practical, offers visual spending summaries, real-time insights, and the ability to set reminders to keep you within your spending limit.

Cook at Home

It’s a good habit to cook at home. It enables us to consume wholesome, fresh food.

We are aware of the ingredients we use when we cook at home.

Food prepared at home is safer and cleaner than food from the store.

In addition, it saves money and strengthens family bonds.

Another practical life skill that everyone should acquire is cooking.

It can also be imaginative and enjoyable!

Cancel Subscriptions

This is often the easiest way to end the agreement and ensure that you won’t be charged by the company again Locate your account: Open the company’s website or app and log in.

Find the settings: Navigate to the area where you can manage your account settings, payment details, or subscriptions.

Do the following: Locate a “Cancel Subscription,” “Manage Plan,” or comparable option, and then adhere to the instructions.

Check and save: After cancelling, save any screenshots or emails you receive confirming your cancellation.

You may still be able to use the service until the end of your current billing period.

Buy in Bulk

Retail bulk stores are the most convenient choice for domestic or personal use.

Warehouse clubs: To gain access to discounted bulk items, such as food, household goods, and electronics, stores like Costco and Sam’s Club demand an annual membership.

Retail establishments: Bigger supermarkets, such as Walmart, also provide bulk options, particularly for paper and food items that are shelf-stable.

Online marketplaces: Azure Standard is a well-known online bulk food retailer that serves buying clubs and ships to many locations in the United States.

Use Cashback Apps

By registering and linking your cards, you can use cashback apps to save money.

Then, when you shop through the app or at participating stores, you can earn rewards or cash back on regular purchases.

While some apps function passively by tracking transactions or sending you to stores via their platform, others require you to add offers or scan receipts.

After that, you can exchange your profits for money, gift cards, or other incentives.

Save First Rule

The “Save First” rule, sometimes referred to as “Pay Yourself First,” is the principle that you should save a portion of your income before using it for other purposes.

One common rule is the 50/30/20 rule, which states that you should set aside 50% of your post-tax income for necessities, 30% for wants, and 20% for debt repayment and savings.

An alternative approach is the 80/20 rule, which states that you should save 20% of your income first and use the remaining 80% for all other expenses.

You can also check out this post:

10 Common Financial Mistakes to Avoid

How to Plan a Monthly Budget Easily

Best Online Banks for Savings in 2025

How to Build an Emergency Fund in 6 Months

Conclusion

Budgeting isn’t rocket science, but it’s a lot of planning and discipline.

For example, cancelling subscriptions, buying in bulk, using cashback apps, and adhering to the “Save First Rule” are all important.

It’s also crucial to have simple and sustainable lifestyle choices.

Chhoti chhoti aadatein hi bade farq laati hain—aur jab ye aadatein aapki life ka hissa ban jaati hain, to aap apne goals ke kareeb pahunch jaate ho bina stress ke.

Toh aaj se hi ek chhota step lo, apne paise ko samjho, aur apni financial journey ko intelligent aur self-assured banayo!