Introduction

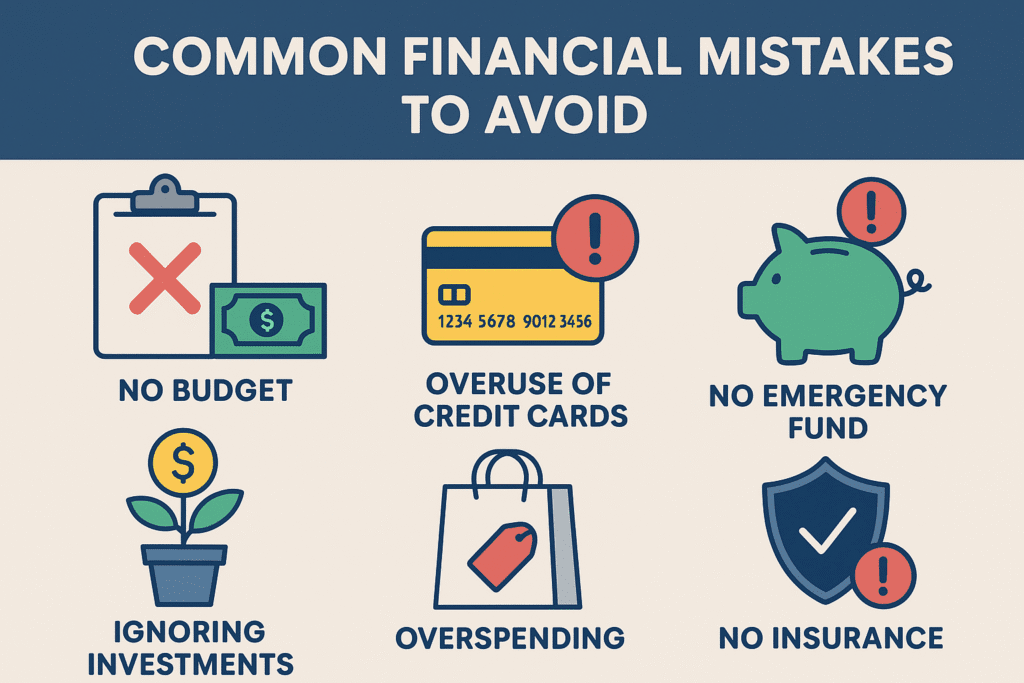

Your financial wellbeing depends on managing money efficiently, and just about everyone makes the same mistakes when it comes to managing their finances, which keeps them from accomplishing their goals. Most people pay too much for things they don’t need, or fail to save or invest, and way too many people do these without even realizing it. The first step to creating sustainable financial habits is to identify the mistakes we make with money. No matter if you are just starting your career, or you have a really nice salary, you will be in a better financial place if you avoid these types of financial traps. Once you have the skills to budget and save, and make the smart financial choice, you will sleep better at night, not only secure in your future, but in peace. Now, here are some of the more common mistakes we would like you to try and avoid.

No Budget

One of the most common financial mistakes people make is creating and sticking with a budget. It is so very easy to lose track of where your money is going every month when you don’t have a budget. You could be spending more than you earn, leaving little or nothing for your savings and emergencies. A budget enables you to evaluate your income, spending, and financial priorities. In addition, a budget can help you set parameters, plan for future expenses and spending, and put an end to unnecessary spending. Many claim that a budget is so limiting, but in reality, it will enable you to take control over your finances and achieve your goals quicker. Be it through using a pen-and-paper notebook, using an app, or even a spreadsheet, consistently tracking your money is financial discipline. Drawing up a realistic budget is one good habit in building and maintaining a healthy financial life without the stress.

Overuse of Credit Cards

A credit card can be handy, but overuse can quickly become one of the most common mistakes of handling money. Many people depend on credit cards too much for everyday purchases and often forget they are borrowing money, which they have to pay back with interest. This can often result in piling up debt and larger-than-normal monthly payments that really create a budget burden. Overspending on a credit card might also impact your credit score in case you miss a payment or surpass your limit. By using a credit card for only what is already planned for expenses, and paying it off in full each month, you can avoid this cycle. Setting up spending limits and monitoring your usage will help you maintain some discipline. Using a credit card wisely can help establish good credit, while misusing a credit card can easily lead to financial trouble.

No Emergency Fund

Failing to keep an emergency fund is a very costly and stressful mistake if you encounter unforeseen circumstances. Every day is a gamble — health insurance premiums, job loss, or emergency repairs to your home could occur at any time. Most likely, without savings, people will typically use credit cards or loans at higher interest rates, putting themselves in debt and financial stress. An emergency fund acts as a financial cushion you can turn to, in order to accommodate emergencies. It’s best to have between three to six months’ worth of expenses set aside that cover only essentials such as rent, food, services, etc. You can easily build an emergency fund over time by saving a small portion of your income every month. An emergency fund contributes to financial protection, but it provides peace of mind, knowing that you are prepared for the uncertainties in life.

Ignoring Investments

Too many people only stress the need to save money without being able to realize the importance of investing, and this may be a very serious mistake in the area of finance. Saving is good for discouraging spending and keeping your money safe, but saving your money alone doesn’t create growth quickly enough to outpace inflation. Investing your savings allows your money to earn a return while working for you and will build wealth over time. By not investing your savings, you are missing out on earning higher returns on his savings for your future. Be it stocks, mutual funds, real estate, or retirement accounts, investments made intelligently, with diligence, and patience will get you better positioned to achieve your long-term goals, whether buying the first home or retiring comfortably.

Overspending

One of the most common money errors is overspending, which insidiously harms your financial well-being. Many people are not wise with their spending, and they spend more than they earn generally on things that they may want but do not need-such as dining out frequently, gadgets that are not needed, or impulse purchasing on clothes and other items. Overspending can lead to debt, stress, and limited savings. The main way to avoid overspending is by being aware of your spending, and separating needs from wants. Setting limits on spending, and following a basic budget, can help to keep over-spending in check. Cash or debit card purchases can provide more awareness than credit card purchases.

No Insurance

Not having insurance is a financial mistake that most people later regret. Life is unpredictable, and accidents, injury, illness, or property damage all create unexpected expenses. These are costs for which one has not budgeted, and without insurance, this means funnelling savings or going into debt to cover these costs. For protection against such financial distress, health insurance, life insurance, auto insurance, and home insurance are important for you and your family. A good insurance policy allows you to rest assured that an unwanted emergency will not destroy your finances. While people look at premiums as an added expense, having insurance is actually a smart investment in securing your finances.

Impulse Buying

Impulse spending is a behavior that can undermine even the soundest financial plan. It manifests itself at the moment of purchasing something without having given any consideration for the necessity of that item. These unplanned and small purchases-trendy clothes, gadgets, or snacks-can seem harmless. Still, the frequency of these purchases can add up, causing damage to your savings. Marketers will often use discounts and limited time offers to incite and take advantage of your impulse spending. To avoid this mistake, make sure when you are about to purchase something that is not necessary, you take time to think about it. Make a shopping list and stick to that list, and don’t peruse online shops when you’re bored.

Wrong Schemes

The other common money mistake is investing in poor or bad schemes which can result in big losses. Many persons see offers for quick profits or for sham investment plans or for online plans which they haven’t entertained, or for an irrational rate of return on your investment. If you don’t study those reasons and directly invest your hard-earned money, you can definitely fail in your efforts to make money. Remember that if something is too good to be true, then it probably is. Always take the time to study the details, research the background of the company in question, and seek others in the professional world to help you make the most informed decision you can about your investment.

No Financial Learning

Poor financial literacy is a limiting factor to many people trying to live a life of true independence. If one does not understand how money works, including budgeting, saving, investing, or debt management, making poor financial decisions is pretty easy to do. Some individuals simply avoid learning about financial literacy because they believe it is too complicated, but you would be surprised what a little bit of financial education can do for your future.

Conclusion

Financial well-being and peace of mind are vital, so common money mistakes should be avoided. Minor mistakes-like overspending, not investing, and delaying on insurance-do not seem so bad on the surface, so they are usually ignored or neglected, but may have disastrous long-term consequences. Whatever your income, good habits-in particular, budgeting, saving consistently, and learning about money-will keep you in control of your money and your finance. Becoming financially savvy does not happen overnight; the process takes time, commitment, discipline, and learning.